Cash Managment Tailor-made solutions to fit your daily business needs

Our product and services offer a wide and efficient possibility to manage your liquidity opportunities for your business. Our product experts who tirelessly work on providing an efficient, easy, reliable customer experience will support your daily business activities.

Cash Management Products

Cash Management Service and Products stands for:

- Customer Orientation

- Product Innovation

- E-business solutions

- Price transparency

- Global Services

Cash Management products include the following services:

- Current Account

- Deposit (Term Deposit and Business Saving Accounts)

- Domestic & International Payment

- Cash Collection & Transporting

- SWIFT Messages

- E-Banking

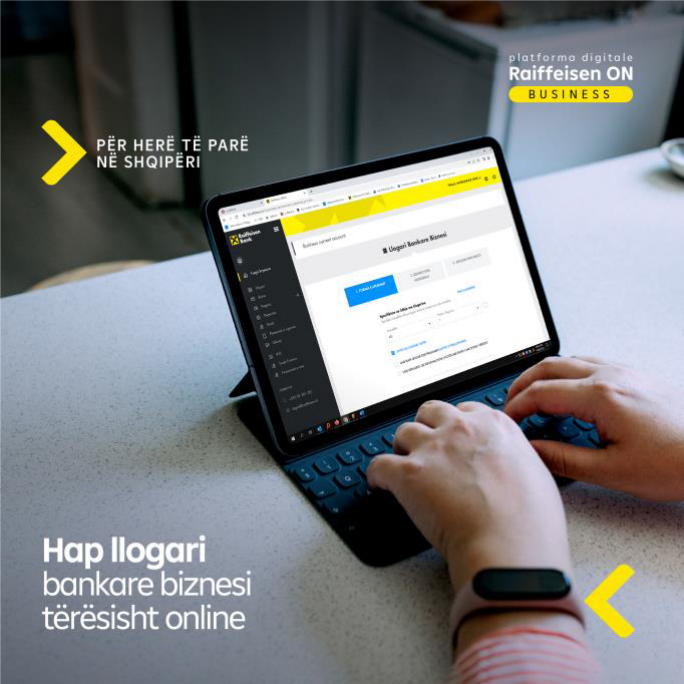

Business Accounts Online Application

Corporate Companies can open new current accounts and additional accounts without the need to visit our branch network. All this process is now possible online. Our Digital Platform RON has been enriched with this functionality to facilitate client’s daily business. Every company that uses RON can easily benefit from this online service. Save time, traffic, queues, and work from the comfort of your office.

- 1. Payments

- 2. Bank Accounts

- 3. Swift messages

- 4. Other

Raiffeisen Bank Albania is the best alternative for Global Companies!

With the most innovative digital banking and our wide network we ensure the most efficient way to process payment. Raiffeisen bank Albania enable you to transact globally with speed , accuracy by saving you time and resources and proving utmost transparency.

SWIFT GPI

Raiffeisen Bank Albania now is part of SWIFT GPI COMMUNITY, which dr matically improves cross-border payments across the correspondent banking network, and not least for corporates for whom: speed, certainty and a smooth international payments experience is an absolute must.

Swift GPI ensures that international payments meet the industry’s needs for speed, traceability, and transparency. Raiffeisen Bank Albania will provide to the business customers with a transformed payments experience, enabled through easy to use and simple to set up digital tools.

What are the benefits:

Real-Time Payment Updates

One of the key features of our new application is its ability to update payments in real time. This means that as soon as a payment is initiated or received, the system will reflect the changes instantly. This advancement significantly reduces delays and ensures that transaction records are always up to date.

Payment Tracking

In an increasingly globalized world, tracking international payments accurately is paramount. Now it is more easy to monitor payments across borders, ensuring transparency and reliability in Business financial operations.

Efficiency and Speed

Swift payments updates are no longer just a goal but a reality. This service offers lightning-fast payment processing and updates, enhancing the overall efficiency of liquidity management.

Payment Service

Do you need a flexible way to process your payments, easily, quickly, and transparently?

Find out more on different type of solutions that Raiffeisen Bank Offers:

Raiffeisen Bank offers the business customer’s current accounts in different currencies, to manage in the most appropriate way their funds.

Choosing to open a bank account is like choosing other products.

Companies are able to open new current accounts and additional accounts without the need to visit our branch network. All this process now is possible online. Our digital platform RON has been enriched with this functionality to facilitate client’s daily business. Every company that uses RON can easily benefit from this online service. Save time, traffic, queues, and work from the comfort of your office.

Raiffeisen Bank Albania can deliver to the customer’s swift messages as below:

SWIFT MT 940/942

- MT940- electronic statement of the transactions for the previous day.

- MT942- electronic intra-day transaction report.

These messages can be sent by S.W.I.F.T to a Financial Institution or Corporate (member of SCORE) which is authorized by the account owner to receive it.

The Statement and Transactions Files are created automatically by the core Banking System; at the frequency choose by the Customer.

- MT940 is generated and sent in both cases: when there are transactions in the account and no transactions in the account.

- MT942 is sent during the day (Intraday statement) to report posted movements not already reported and/or expected movements (shadow posting).

SWIFT MT 101

The SWIFT MT101 message is a request for transfer, enabling the electronic transfer of funds from one account to another. Funds are transferred from ordering customers account to a receiving financial institution or account servicing financial institution.

On the Deposit Insurance

The Deposit in Raiffeisen Bank is insured for the amount up to 2.500.000,00 (two million and five thousand) Lek by the Deposits Insurance Agency - www.asd.gov.al, according to provisions of Law no. 53/2014, date 22.05.2014 "On the Deposits' Insurance" as amended.

If you are looking for the deposit that gives greater benefit, there is no better choice than a Business Saving Account Deposit at Raiffeisen Bank. With this Deposit, you can have total access to your funds without being concerned about losing the accumulated interest.This is the best account to save money. A Raiffeisen Business Savings Account offers you easy access to your money when you need it. You can earn more if you keep your money in the account. You can deposit in: LEK, EURO, USD and GBP. Different interest rates apply for different currencies.

Term Deposit

Is an agreement between the Bank and the customer, by which the customer is eligible to deposit a certain amount (principal) for a certain period towards an interest rate applied.

Please contact the Bank to be informed about the product terms and conditions.

Saving Deposit

If you are looking for a deposit that gives greater benefit, there is no better choice than a Business Saving product. With this Saving Account, you can have total access to your funds without being concerned about losing the accumulated interest.

This is the best account to save money. Business Savings Account offers you easy access to your money when you need it. You can earn more as long asyou keep your money in the account. You can deposit in: LEK, EURO, USD and GBP. Different interest rates apply for different currencies.

Cash Pick UP

Raiffeisen Bank offers business customers the possibility to collect their cash funds in their point of sails/business premises.

Corporate customers can authorize Raiffeisen Bank to collect cash deposits at various business locations and pick them up at a pre-arranged schedule depending on the customer’s needs.

Raiffeisen Cash Pick Up Service

offers all the necessary security level of service that customers need to move

cash. Cash deposit bags should be closed with a security strip when they are

collected by the security company. One deposit slip accompanies each bag. After the cash is counted and verified at Raiffeisen Bank, the amount is immediately credited in the company account.